The Alabama Life and Health Insurance Exam is a critical step for professionals seeking licensure. This guide provides a comprehensive overview, helping candidates understand the exam’s structure, key topics, and essential strategies for success.

1.1 Overview of the Exam

The Alabama Life and Health Insurance Exam assesses knowledge of insurance concepts, state regulations, and product details. It includes multiple-choice questions covering life insurance policies, health plans, and legal requirements. Candidates must demonstrate understanding of key terms and practical applications. The exam is a crucial step for obtaining licensure, ensuring professionals are well-prepared to advise clients effectively. A structured study guide is essential for navigating the exam’s content and achieving success.

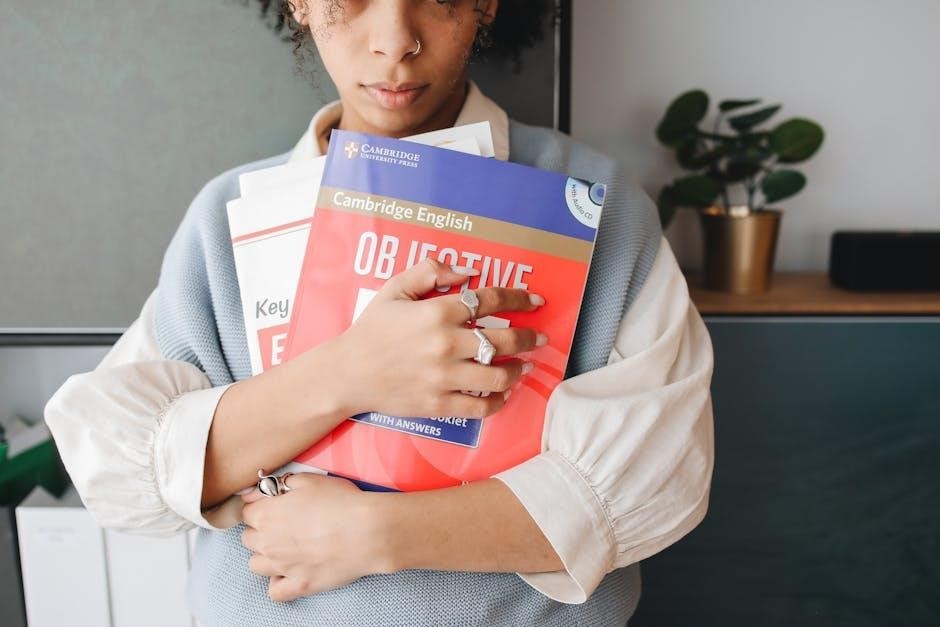

1.2 Importance of the Study Guide

A comprehensive study guide is essential for success on the Alabama Life and Health Insurance Exam. It provides in-depth coverage of key topics, including state-specific regulations and core insurance principles. The guide offers practical advice, sample questions, and strategies to help candidates understand and retain complex information. By following the study guide, individuals can efficiently prepare, identify knowledge gaps, and build confidence, significantly increasing their chances of passing the exam and achieving licensure.

Exam Format and Content

The Alabama Life and Health Insurance Exam features multiple-choice questions covering insurance regulations, product knowledge, and state-specific laws. The content is divided into sections, ensuring a thorough assessment of a candidate’s understanding of life and health insurance principles.

2.1 Breakdown of Exam Sections

The Alabama Life and Health Insurance Exam is divided into sections, each focusing on specific areas of expertise. These include life insurance policies, health insurance plans, and state-specific regulations. Candidates must demonstrate a strong understanding of key concepts, such as policy types, riders, and benefits. The exam also covers ethical practices and legal requirements. A thorough grasp of these sections is essential for success, ensuring candidates are well-prepared for the challenges of the exam.

2.2 Types of Questions and Time Limits

The exam features multiple-choice questions designed to test knowledge and application of insurance concepts. Candidates typically have a set time limit to complete the exam, ensuring they manage their time effectively. The questions are balanced between life and health insurance topics, with a focus on state-specific regulations. Practice exams and study guides help candidates familiarize themselves with the format and timing, enabling them to approach the actual exam with confidence and precision.

Key Concepts in Life Insurance

Understanding life insurance policies, riders, and legal requirements is essential. This section covers fundamental concepts, including policy types, underwriting, and claims, preparing candidates for the exam.

3.1 Types of Life Insurance Policies

Life insurance policies include term life, whole life, and universal life options. Term life provides temporary coverage, while whole life offers lifetime protection with cash value growth. Universal life combines flexibility with adjustable premiums and death benefits. Each type serves different needs, and understanding their features is crucial for success on the Alabama exam.

3.2 Riders and Add-ons

Riders and add-ons enhance life insurance policies by offering additional benefits. Common riders include the waiver of premium, accelerated death benefit, and long-term care. These options allow policyholders to customize coverage, addressing specific needs like disability or terminal illness. Understanding riders is essential for tailoring policies and passing the Alabama exam, as they impact both coverage and premiums, providing flexibility and financial security for various life scenarios.

3.4 Key Terms and Definitions

Understanding key terms is vital for success on the Alabama Life and Health Insurance Exam. Important definitions include premium (cost of the policy), deductible (amount paid before insurance kicks in), and beneficiary (recipient of policy benefits). Terms like face value (policy’s death benefit) and cash value (savings component in permanent life insurance) are also critical. For health insurance, terms such as copayment and coinsurance are essential. Mastering these definitions ensures a strong foundation for exam questions.

Health Insurance Fundamentals

Health insurance provides coverage for medical expenses, ensuring access to necessary care. Understanding policy types, benefits, and limitations is crucial for making informed decisions and passing the exam.

4.1 Types of Health Insurance Plans

Health insurance plans vary, offering different levels of coverage and flexibility. Common types include Health Maintenance Organizations (HMOs), which require in-network care, and Preferred Provider Organizations (PPOs), offering more flexibility. Exclusive Provider Organizations (EPOs) combine elements of HMOs and PPOs, while Indemnity Plans provide reimbursement for medical expenses without network restrictions. Understanding these differences is essential for selecting the right coverage and preparing for the exam.

4.2 Benefits and Limitations

Health insurance plans offer significant benefits, such as financial protection against medical expenses and access to essential care. However, limitations exist, including network restrictions, deductibles, and coverage gaps. Understanding these aspects helps individuals make informed decisions. For instance, plans may cover preventive care but limit coverage for specialized treatments. Balancing affordability and comprehensive coverage is key, ensuring policyholders are prepared for both routine and unexpected healthcare needs while adhering to plan constraints.

4.3 Key Terms and Definitions

Understanding key terms is vital for mastering health insurance concepts. Premium refers to the cost of the policy, while deductible is the amount paid before coverage begins. Copayment and coinsurance are out-of-pocket expenses for services. Pre-existing condition exclusions may apply, and network providers offer discounted care. Grasping these definitions ensures clarity and confidence when addressing policy details and exam questions effectively.

Alabama Insurance Regulations

Alabama insurance regulations ensure compliance with state laws and federal standards. The Alabama Department of Insurance oversees licensing, policy standards, and consumer protections, ensuring fair practices and accountability in the industry.

5.1 State-Specific Laws and Rules

Alabama’s insurance laws are designed to protect consumers and regulate industry practices. Key areas include policy disclosure requirements, beneficiary designations, and claim settlement processes. The state mandates a 30-day grace period for premium payments and requires insurers to provide clear explanations of coverage terms. Additionally, Alabama enforces strict rules against unfair claims practices, ensuring timely and fair resolutions. Understanding these regulations is crucial for exam success and professional compliance.

5.2 Role of the Alabama Department of Insurance

The Alabama Department of Insurance oversees the state’s insurance industry, ensuring compliance with laws and regulations. It licenses insurance professionals, monitors carrier solvency, and investigates consumer complaints. The department also enforces ethical standards, protecting policyholders from unfair practices. Understanding its role is vital for candidates, as exam questions often address regulatory oversight and consumer protection. Familiarity with the department’s functions aids in navigating industry requirements and expectations.

Study Materials and Resources

Essential resources include the Alabama Life and Health Insurance Exam Study Guide, online practice exams, and flashcards. These materials cover key concepts and exam formats effectively.

6.1 Recommended Study Guides

Top resources include the Producer Life and Health Examination Study Guidebook and the Alabama Insurance Law Guide. These materials provide detailed coverage of exam topics, practice questions, and state-specific regulations. Additionally, online tools like Quizlet offer flashcards for key terms. The Alabama Life and Health Insurance Exam Study Guide is highly recommended for its structured approach and comprehensive content. These resources ensure thorough preparation and familiarity with the exam format, boosting confidence and knowledge retention.

6.2 Online Practice Exams and Tools

Utilize online practice exams and tools to enhance your preparation. Platforms like Quizlet offer flashcards for key terms, while dedicated websites provide full-length practice exams. These resources simulate real exam conditions, helping you assess your knowledge and identify weak areas. Many tools include detailed explanations for correct and incorrect answers, ensuring a deeper understanding of complex topics. Regularly using these resources can significantly improve your retention and exam performance, making them indispensable for successful preparation.

Exam Preparation Strategies

Develop a structured study plan and use active learning techniques to master key concepts. Regular practice and review ensure a strong foundation for exam success.

7.1 Creating a Study Schedule

Creating a detailed study schedule is essential for effective exam preparation. Break down the material into manageable sections and allocate specific time for each topic. Set realistic daily goals and include regular breaks to maintain focus. Consistency is key, so stick to your schedule and adjust as needed. Prioritize challenging areas and ensure ample time for review. A well-organized plan helps build confidence and ensures thorough preparation for the Alabama Life and Health Insurance Exam.

7.2 Effective Study Techniques

Effective study techniques involve active learning and engagement with the material. Use flashcards to memorize key terms and concepts. Practice with sample questions to familiarize yourself with the exam format. Review and summarize notes regularly to reinforce understanding. Engage in self-testing to identify weak areas and focus your study efforts. Utilize study groups or discussion forums for collaborative learning. Incorporate breaks and mindfulness practices to maintain focus and reduce stress during preparation.

Practice Questions and Answers

Engage with sample questions from past exams to familiarize yourself with the format and content. Review answers to understand correct responses and common mistakes.

8.1 Sample Questions from Past Exams

Reviewing sample questions from past exams helps candidates understand the format and content. For example:

- Which Alabama state-specific regulation governs life insurance policy cancellations?

- What distinguishes term life insurance from whole life insurance?

- How does the Alabama Department of Insurance oversee health insurance plans?

These questions cover key topics like regulations, policy types, and state-specific laws, preparing candidates for the actual exam.

8.2 Common Mistakes to Avoid

Identifying common mistakes is crucial for exam success. Many candidates overlook state-specific regulations, such as Alabama’s unique insurance laws. Others mismanage time, failing to answer all questions. Some confuse life and health insurance concepts, like policy riders versus exclusions. Avoiding these errors requires thorough preparation, including understanding Alabama’s Department of Insurance roles and staying calm during the exam. Proper time management and clear concept differentiation are key strategies to avoid these pitfalls. Preparation is essential to ensure success. Words: 76

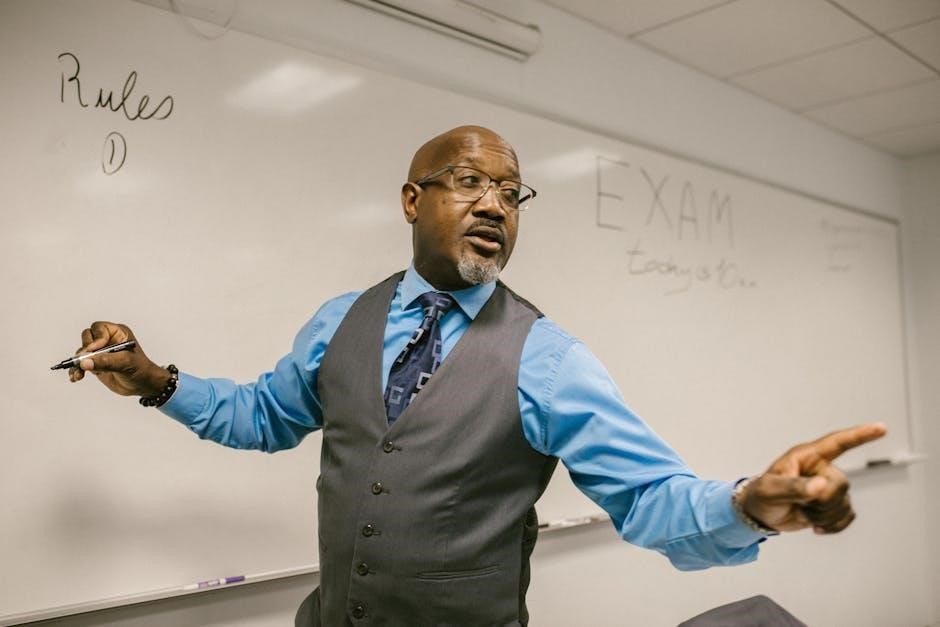

Final Exam Tips

Arrive early, stay calm, and manage time wisely. Review key concepts beforehand and use practice exams to build confidence. A well-structured study schedule ensures readiness.

9.1 Test-Taking Strategies

To excel on the Alabama Life and Health Insurance Exam, employ effective test-taking strategies. Arrive early to reduce stress and manage time wisely during the exam. Skim through all questions first to identify easier ones and tackle them early. Use the process of elimination to narrow down answers, and avoid changing answers once decided. Practice with sample questions to build familiarity and confidence. Stay focused and maintain a calm mindset to ensure optimal performance.

9.2 Managing Exam Day Stress

Managing exam day stress is crucial for optimal performance. Start with deep breathing exercises to calm your nerves. Visualize success to boost confidence. Arrive early to avoid last-minute rush. Stay hydrated and avoid heavy meals. Bring necessary materials to feel prepared. Take short breaks between sections to refresh your mind. Focus on the present moment and tackle each question step-by-step. Remember, thorough preparation is your best tool to stay calm and composed during the exam.